Counterparty Book

About

Hex Trust is committed to helping clients comply with Travel Rule regulations, particularly in Singapore and the MENA region. These regulations mandate that VASPs collect and verify sender and recipient information for transactions exceeding defined thresholds. Additionally, VASPs must ensure secure information sharing with compliant counterparties to mitigate risks associated with unverified or non-compliant parties, including unhosted wallets.

To streamline compliance, Hex Trust is introducing a Counterparty Book feature. This tool allows clients to:

- Associate blockchain addresses with counterparties, whether individuals or companies.

- Link counterparties to their respective VASPs or indicate if they operate as VASPs themselves.

- Provide supplementary information about counterparties and transactions, enhancing transparency and due diligence.

For transactions above regulatory thresholds, clients will need to declare:

- Counterparty details, including associated VASPs.

- Supplementary information related to the transfer.

- The type of transaction, categorized as technological or financial.

The Counterparty Book simplifies compliance, enabling Hex Trust’s clients to navigate regulatory requirements with confidence while maintaining secure and transparent operations.

Counterparty Creation and Management:

A Counterparty is a person/entity a wallet may transact with. The goal of the CPB is to provide a handy tool to save and manage such CPs not only as part of Travel Rule requirements but also in view of developments such a Hex Trust network/ecosystem of counterparties that enjoy certain benefits when transacting with each other.

- View Counterparties: Go to Settings → Counterparty Book

- Create a Counterparty: Click “Create Counterparty”, then input Full Name (for Individual) or Legal Name (for Company) and input Additional Counterparty Information (optional, but will be used for Travel Rule compliance during transactions)

- Add Address to a Counterparty:

-

- You can add multiple addresses in one request.

- Address fields include: Address(required), Network(required), Address Label(required), Wallet Source (optional), Memo (optional). While “Wallet Source”:

- Select from VASPs/CASPs or Self-Hosted.

- Self-Hosted addresses will require verification.

Adding or updating addresses creates a request requiring the Admin approval.

Deposit Flow:

If you are a non-intermediary institution:

- Your “Own Profile” will be the default beneficiary.

- Hex Trust will be the default VASP beneficiary.

If you are an intermediary institution:

- Hex Trust will be the default VASP beneficiary.

If you are an intermediary or non-intermediary institution:

- Matching Counterparty Detected: If the incoming deposit address matches an existing address (name, address, and required additional info) in a counterparty, no declaration is required.

- No Matching Counterparty: If no address match exists, the deposit is flagged as “Pending Originator/Beneficiary Declaration Information”. You must submit required originator and beneficiary details before the deposit is processed. The declaration form will differ depending on whether it is a VASP/CASP address or a Self-hosted address.

Declaration step: VASP

- If a counterparty & address is not saved in the counterparty book, it will trigger the enterprise to save the following information:

- Originator Information

- VASP

- Individual OR Company Information

- Additional Information Requirements

- The enterprise is able to save the counterparty on the fly by selecting the box which will trigger an approval.

- Beneficiary Information

- VASP

- Individual OR Company Information

- Originator Information

Declaration step: Self-Hosted Verification

IMPORTANT: Please note that all the self-hosted sections are only applicable to HT Singapore custodian entity.

- If a self-hosted address has not been verified and saved in the CPB and a deposit is sent, you will need to declare the information in the declaration form:

- Originator Information

- Individual Full Name OR Company Information Legal Name

- Additional Information Requirements

- The enterprise is able to save the counterparty on the fly by selecting the box which will trigger an approval.

- Beneficiary Information

- Individual Full Name OR Company Information Legal Name

- Originator Information

- When submitted, the system will create a new counterparty with your input and add the self-hosted address to that counterparty. Adding the address will generate a request that requires 2FA confirmation by an Initiator role and approval from the Admin Approver(s).

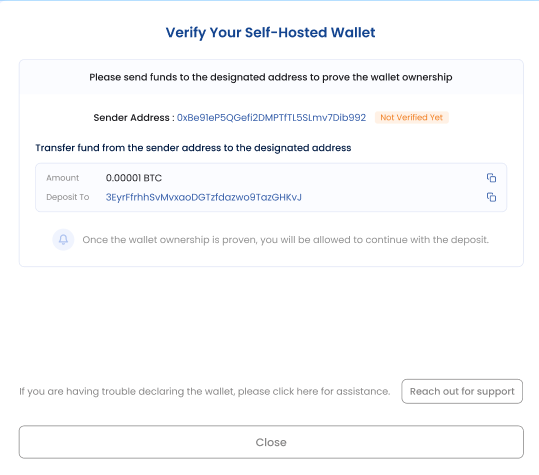

- Once the address has been added to the counterparty, the transaction will move to Pending Wallet Verification. Click Verify Now and send a small transfer (native asset or stablecoin) to the designated address within 24 hours to verify your self-hosted address.

- The platform confirms the balance and checks the chain explorer to verify the funds landed at the address, and input matches exactly.

- The self-hosted address is then marked as verified.

- Counterparty Detected: If a matching counterparty exists in the counterparty book with regard to the name, address and additional information required for an incoming deposit, no declaration of information would be required.

Withdrawal Flow:

If you are a non-intermediary institution:

- Your “Own Profile” will be the default originator.

- Hex Trust will be the default VASP originator.

If you are an intermediary institution:

- Hex Trust will be the default VASP originator.

Users can save a beneficiary counterparty from the counterparty book during the withdrawal process.

When choosing an address for a withdrawal:

- You are able to either select from addresses from the Internal Vaults list or the Counterparty Book.

If an address does not appear under either the Internal Vaults list or under the Counterparty Book in the withdrawal flow, you would be required to verify following information:

If you are an intermediary or non-intermediary institution:

Declaration step: VASP

- Beneficiary Information

- Beneficiary VASP

- Counterparty: Individual OR Company

- Additional Information Requirements

- Ability save as a counterparty and address on the flow: this will trigger a separate approval in addition to an approval related to the withdrawal

Declaration step: Self-Hosted Verification Flows

Users would need to resort to the Counterparty Book to add and verify their self-hosted wallet addresses.

For EVM, Solana, Bitcoin & Other Addresses: please refer to the below steps:

Users would be able to verify their self-hosted wallet addresses by following the instructions. Once the additional transfer is sent to the designated address, the self-hosted wallet address will be verified.

Counterparty Whitelisting:

Whitelisting is a security and compliance feature that restricts asset transfers to a predefined list of approved blockchain addresses. It ensures that digital asset movements are only permitted to known, verified counterparties, helping mitigate the risk of fraud, misrouting, and unauthorized withdrawals.

- Enable Vault Whitelisting

- Administrators can activate whitelisting controls on a per-vault basis, ensuring outbound transactions are restricted to approved addresses only.

- Select Specific Vaults

- Choose which vaults require whitelisting enforcement. This allows flexibility across different accounts or business units.

- Select Counterparties with Linked Blockchain Addresses

- From a managed list of counterparties, users can select those with verified blockchain addresses tied to their entity. These addresses may be associated with exchanges, liquidity providers, institutional clients, or self-hosted wallets that have passed verification checks.

- Whitelist and Approve

- Once selected, the addresses are added to the vault's whitelist. Transactions from that vault can only be executed to these approved addresses, subject to applicable policies.